Acquiring - what it is and why it is needed: definition and meaning of the term + TOP-12 acquiring banks and criteria for their choice

Hello dear readers of the Rich Pro financial magazine! In this article we will talk about acquiring: what is it, what types of acquiring are, how does it work and what is it for.

Nowadays, non-cash cash flow is gaining popularity. Finally, there is no need to worry about whether there is enough money for everything in the wallet, because taking with you only one card is as easy as shelling pears. In addition, if your savings were not enough to buy, you will probably find credit card, which is so easy to use absolutely in any store.

From this article you will learn:

- What is acquiring, what types of acquiring are in demand and what features does it have;

- What to look for when choosing a partner bank and which banks hold leading positions in this area;

- The main advantages and disadvantages of acquiring.

This article will be useful, first of all, for beginners. businessmen and entrepreneurswishing to expand the customer base and simplify cash work, allowing your customers to pay in cashless form. How to choose a bank from which to order this service, how to conclude an acquiring agreement, and most importantly, what equipment to choose for this - read right now!

About acquiring: what is it in simple words, what should be taken into account when connecting services to entrepreneurs (IP, LLC) and what tariffs do acquiring banks have - read on

About acquiring: what is it in simple words, what should be taken into account when connecting services to entrepreneurs (IP, LLC) and what tariffs do acquiring banks have - read on

1. What is acquiring - definition in simple words + features of acquiring without a cash register

First of all, you need to clarify the concept of acquiring.

Acquiring- This is a bank service with which customers can pay for purchases using a bank card without cashing out cash using ATMs.

This procedure allows you to pay online and not waste time shopping.

Small businessthanks to these features, can significantly increase profitsdue to the fact that, according to studies, paying with a card, buyers spend, on average, on 20% morethan in cash.

The acquiring operation is carried out according to a certain algorithm, which is clearly visible on the example of working with POS terminal:

- A bank card is activated in the system, for example, after the owner has entered a PIN code;

- Owner data is verified by the system;

- Funds are debited from the buyer's account and transferred to the operator;

- Two checks are issued: for the client and for the seller;

- The seller signs the check;

- From the cash desk, the customer is issued a receipt for payment.

Between point of sale (which acts as a client) and banking institution an acquiring service contract is concluded. Moreover, the bank or agent provides all the equipment necessary for the implementation of operations.

POS terminal - a special electronic device for cashless payments with plastic cards, which consists of: monitor, system unit, devices for printing and fiscal parts.

For this procedure, a cash register or a simplified POS terminal can also be used. The combination of both devices will cost much more and is used by more successful and well-developed companies. So at the first stages of a business, it’s better to use only a POS terminal for cash management services.

There are 2 (two) methods for acquiring without using a cash register:

- Fixed or portable POS-terminal, which communicates with the bank, through the installed SIM card;

- Internet site that allows you to make cashless payments on the details of a bank card.

Types of cards read by mobile terminals:

- debit cards;

- credit;

- chip;

- equipped with magnetic tape

In order for the payment to be made unhindered, a connection with the bank must be established, and there must be enough funds on the account to pay the full cost.

Pros for a trading company from the use of acquiring:

- minimizing the risks associated with counterfeiting banknotes;

- lack of collection and, as a result, savings;

- increased profitability;

- expansion of a more solvent customer base.

Pros for a buyer paying for goods and services using bank cards:

- the ability to use funds from the card account without cashing out;

- faster and more convenient payment method.

Acquiring in Russia is only developing, while in the whole world it has long been fully formed. One reason for this lag is financial illiteracy of the population and low prevalence of plastic cards among the population, which, finally, has been actively increasing recently.

2. Which parties are involved in acquiring

There are 3 (three) parties involved in this process.

1) Bank (Acquirer)

Provides services for the processing and execution of cashless payments. It provides POS-terminals to retail outlets and keeps under control all operations that are carried out using cards.

As a rule, a credit institution that provides non-cash payment services leases or installs under the terms of an agreement all the equipment necessary for carrying out these operations.

2) Trading organization

Concludes an agreement with the acquiring bank, indicating all the conditions and prices for the provision of equipment, the use of terminals, the volume of bank commissions, as well as the time period in which the funds must be transferred to the seller from the buyer's account. Moreover, any organization that does not even have an account with this bank can receive this service.

3) Customers

These are people who make cashless payments in a trading company.

The principle of acquiring can be understood from the diagram below:

The principle of acquiring according to the scheme

The principle of acquiring according to the scheme

3. How to use acquiring without opening an account and in what cases it may be necessary

To use commercial acquiring in the company’s activities, you need not only to have a bank account, but also have a status legal entity. Therefore, without opening an account at all, use the service exactly merchant acquiring impossible. But where the account is opened, in fact it does not matter. It could be like acquiring bankand any other banto.

Without opening a current account can only work with internet acquiring, which is a transfer of non-cash funds from a bank card of a client-buyer to the account of the seller-seller.

In this case, you can manage financial capital by providing only an individual’s account with any credit institution. Then the acquiring tool for IP allows you not to open a special settlement account, if it previously worked without it.

Legislation allows IP to pay required insurance premiums (fixed payments) and taxes cash on receipt, then if the entrepreneur has, for example, an online store, he can accept cashless payments to his personal account.

However, it is worth paying attention that, despite the absence of a direct prohibition on the use of a personal account in entrepreneurial activity, indirectly, nevertheless, troubles may arise due to the fact that in an agreement on opening an account of an individual, usually, it is indicated, firstly, that the account should not be used for business purposes, and secondly, such income can be regarded by tax authorities as the income of an individual, which requires the payment of personal income tax, in the amount of 13%.

One way or another, if the entrepreneur does not plan to open a current account, the Internet acquiring agreement allows this. In more detail about the opening of IP and the creation of LLC, we wrote in special articles.

When can acquiring be necessary without opening an account?

In the case of the same online store, payment by entering the card details and confirming the operation using the SMS password looks much more reliable than transferring funds to a personal bank card of any particular person. You can find out about the stages and sequence of creating an online store here.

The client, in most cases, does not see or does not pay attention to which account he specifically transfers his money, which means that he will not be confused by the lack of an entrepreneurial current account. In its turn, the consumer receives guarantees from the Acquiring Bank for the safe conduct of the transaction.

4. TOP-4 main types of acquiring

Despite the fact that for Russia this is a relatively new process, it is already possible to single out the main types of acquiring.

Type 1. ATM Acquiring

Appeared first in our country and includes: payment terminals and ATMs, allowing you to replenish and withdraw cash at any convenient time, on your own.

But due to the fact that the percentage of the commission was subsequently legally limited, it is impossible to get a lot of income from it, especially since their large selection allows consumers to find terminals with the lowest commission. You can, perhaps, make money on rent, when installing a terminal with a bank or a payment system, such as Qiwi.

Type 2. Trading Acquiring

Most popular varietyused for pay for services and household goods, outlets, catering places.

In this case, the payment is made through the POS terminal, which is connected to the cash register, which is a key condition.

It can be purchased in full or leased from the bank, it can be mobile or stationary.

During the operation, 2 (two) checks are issued - cash and checks of the terminal itself (slip).

View 3. Mobile acquiring

Relatively new way payment by cards and so far little known. This will require the tablet or smartphone and special card readerassociated with it using usb, bluetooth or specialist. connector.

Such a device will cost significantly less than a POS terminal and can even be issued by some banks completely is free.

At the time of payment, the seller passes the magnetic stripe card through the card reader, giving the buyer the opportunity to sign on the smartphone / tablet screen, if a chip card is used, then a PIN code will be required.

The low popularity of this method is due to the fact that at present no effective protection of software against viruses and fraudulent attacksallowing illegal access to the details of the account or directly to the funds located on it.

In addition, the payment itself is longer and more complicated, due to the fact that you need to start the application first, perform all the necessary actions from the menu, indicate mobile number or customer e-mail, get his signature.

In addition, the process is complicated by the absence of a slip and the "issuance" of only an electronic check, and, according to the law No. 54-ФЗ dated May 22, 2003, cash receipt required, even when making a purchase using bank transfer. Accordingly, in this case, you need to connect a cash register.

Type 4. Internet Acquiring

It is a payment using a special interface for entering the details of a plastic card and subsequent confirmation of purchase by entering the password received in SMS. Convenient for use by various online stores, pay for tickets, of services. In this case, various payment operators can be used, such as, Robokassa, Interkassa, PBK-money and others. In this case, upon delivery of the goods, the check is not issued, but is sent only in electronic form.

If, however, the buyer wants to have the physical form of the check, he needs to place an order on the website and pay for it directly at the time of transfer of the goods using the same POS terminal at the courier or at the point of sale.

More information about Internet acquiring, as well as about mobile and commercial acquiring, can be found in the article here.

5. TOP-12 banks for the provision of acquiring services

Currently, almost every Russian bank can offer acquiring services. Most credit organizations practice an individual approach in the field of this service and draw up personal working conditions (tariffs) for each individual client.

In order to learn more about acquiring tariffs in a particular bank, you need to fill out a form on the bank’s website or call these numbers. Personal offers, most often, are much more profitable than standard ones.

Determining profitable acquiring for private entrepreneurs (individuals) or not is possible thanks to a thorough study of acquiring tariffs. As a rule, the official websites of banks provide detailed and relevant information about these services.

To conclude an agreement for a specific business, you can compare the tariffs (offers) of various banks, the most popular of which are presented in the rating table below:

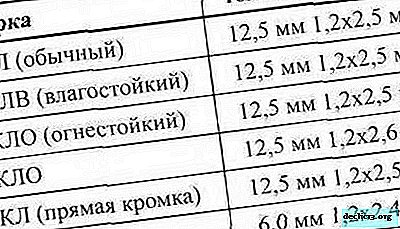

| № | Acquiring bank | Acquiring Terms | Acquiring Cost (Price) |

| 1 | Gazprombank | Provides Internet, mobile and merchant acquiring services. | Personal rates from 1.5% to 2%, the cost of equipment is 1750 rubles / month. |

| 2 | MTS Bank | Serves Visa, MasterCard, American Express, MIR, UnionPay. provides POS-terminals, uses GSM / GPRS communication. | Commission 1,69%, equipment 1499 rubles / month. |

| 3 | Raiffeisenbank | It offers all types of acquiring, according to the standards of connection via a telephone line, GSM and Wi-Fi. | Bid not higher 3,2%. The price of rental equipment is set depending on how many jobs are in the organization and what type of service software is selected. For Visa and Mastercard cards with mPos terminal, the rate is 2.7%. for commercial and Internet acquiring is established by the contract, as a rule, up to 3.2% |

| 4 | Sberbank of Russia | Acquiring in Sberbank is carried out through the payment systems Visa, Visa Electron, MasterCard, MasterCard Electronic, Maestro, MIR, with the provision of mPos-terminals compatible with smartphones / tablets and POS-terminals based on communication via 2G / 3G, Wi-Fi, GSM / Gprs You can familiarize with the tariffs for individual entrepreneurs and legal entities on the bank’s website. | Acquiring cost in Sberbankfrom 0.5% to 2.2% (trade - over 1.5%; Internet - from 0.5%; mobile for entrepreneurs - 2.2%). Equipment from 1700 to 2200 rubles / month. |

| 5 | Alfa Bank | The main payment systems Visa, MasterCard, also when connecting to the acquiring service in Alfa Bank, the following equipment is provided: mPos terminals compatible with smartphones / tablets, with 2G / 3G, Wi-Fi connection | On the Internet and merchant acquiring - installed individually. Mobile Acquiring - 2,5%. Equipment, on average, 1850 rubles / month. |

| 6 | Uralsib | Serves Visa, VisaPayWave, MasterCard, Universal Electronic Cards, American Express, MIR. Provides for rent POS-terminals, with support for Dial-up, Ethernet, GSM, GPRS, Wi-Fi. funds are credited in 1-2 days. | Rate from 1.65% to 2.6%, The cost of equipment is from 1600 to 2400 rubles / month. |

| 7 | Tinkoff | Tinkoff Bank focuses on Internet acquiring | Commission amount - from 2 to 3.5% equipment 1900-2300 rubles / month. |

| 8 | Opening | Services are provided for installation of equipment, reception of all payment instruments, and staff training. | Tariff rate fluctuates from 0.3% to 3%. Equipment will cost, on average, 2350 rubles / month. |

| 9 | Russian Agricultural Bank | Conducts staff training and presents the necessary equipment. | Personal approach in setting tariff rates. |

| 10 | VTB 24 | We accept Visa and MasterCard payment cards. Equipment is provided for use in the form of POS-terminals and cash registers. As a connection, Wi-Fi, GSM / GPRS are used. You can familiarize yourself with acquiring tariffs in VTB 24 on the bank’s website. | Set bid from 1.6%, depending on the selected service system. Equipment costs about 1600 rubles / month. |

| 11 | Vanguard | Plastic cards are serviced in Visa and MasterCard systems. POS terminals are provided, communication via GSM / GPRS is used. It also provides the right to change additional security settings, independently. Money transfer is carried out in the period from 1 to 3 days, | Tariff rate from 1.7% to 2.5%. |

| 12 | Russian standard | Cards of payment systems Visa, VisaPayWave, MasterCard, American Express, Discover, DinersClub, JCB and Golden Crown are accepted. Acquiring terminals are presented: POS-terminals and network cash solutions. When acquiring at the Russian Standard Bank, GSM / GPRS is used as a connection. | Tariff rates within 1,7-2,5%. |

Based on the data presented in the table, we can conclude that the proposals of banks represent approximately one level of tariff ratesto, where the price of acquiring varies depending on the terms of the contract and the related services provided.

How to choose a bank and connect acquiring - selection criteria + documents for registration of a service

How to choose a bank and connect acquiring - selection criteria + documents for registration of a service

6. How to choose a bank for concluding an acquiring agreement - 8 criteria for choosing an acquirer bank

Before deciding on the choice of an acquiring bank, you need to study in detail the working conditions proposed by him, as well as be sure to compare them with the offers of other financial institutions. To do this, the contract proposed by the bank will need to be evaluated according to the following criteria:

Criterion 1. Equipment provided by the bank

The speed of connection to the server and the security of cashless payments using cards depend on the hardware and software.

Depending on the terms of the contract, acquirers may offer:

- POS-terminals or POS-systems (the device itself for reading data from cards, keeping records of sales and conducting trading operations, or a whole range of devices representing a cashier’s finished workplace);

- Imprinters (devices that execute a slip in payment transactions using cards. A cliche is used with identification data of the point of reception, a card is inserted and a slip is inserted, on which there remains an imprint of the data and the plastic card);

- Processing centers (systems ensuring the functioning of the payment system between acquiring parties);

- Cash registers (devices registering the fact of money exchange and intended for issuing the necessary cash receipt);

- PinPad (panels for reading information from cards and entering pin codes).

Using POS terminals more budgetary and effective option, while the use of a cash register may entail additional financial costs.

Criterion 2. Type of communication with which the terminal connects to the bank

The speed of connection and execution of operations depends on the type of such connection.

A request to write off money from an account can be carried out in the following ways:

- using the GSM network;

- remote dial-up access (when using a modem and landline telephone service);

- through the Internet;

- thanks to GPRS packet connection;

- via wireless wifi

The fastest (1-3 sec) types of communication is the Internetand Wifias well as a modem connection and GPRS, which is subject to an additional charge.

Criterion 3. Payment systems with which the bank works

Payment system - This is a service that is responsible for the transfer of funds from account to account. Each bank cooperates with some of them, which may turn out to be fundamentally important for the identification of specific plastic cards. The more payment systems are serviced, the wider the range of customer base.

The main payment systems in our country are: Visa and Mastercard. If the work requires cooperation with foreign citizens or premium customers, you should pay attention to such payment systems as: Diners club, American express (AmEx), Jcb.

Russian payment systems are gaining popularity due to reduced tariff rates for payment: gold Crown, PRO100, Union card.

Criterion 4. Carefully study the terms of the contract

All key points of interaction between the parties are indicated in the contract. Therefore, in order to avoid questions and unexpected surprises in the process of cooperation, a careful study of all points - required condition.

In case of failure to fulfill the obligations of one party or another, it is the agreement that will serve as the occasion and the main tool for going to court and defending one’s interests.

Criterion 5. Evaluation of the level of service

It is at what level the service is provided that determines the cost of such a service. In addition to the fact of acquiring and providing equipment for quality work, provider can also carry responsibility for maintenance, timely troubleshooting, maintain a 24-hour service center, where you can get answers to all questions and quick response in case of difficulties, breakdowns, etc.

In addition, a highly qualified acquiring organization necessarily accompanies the provision of services with training and consulting staff at the point of sale on the following issues:

- How to determine the authenticity of a bank card;

- what are the details and types of cards;

- main nuances of the equipment;

- in what order is customer service provided;

- how to make a refund for non-cash payment;

- how to cancel authorization;

- and etc.

In addition to training to work with the system itself, often banks, for a fee, conduct more advanced trainingswhere they teach:

- ways to identify fraudsters and the procedure for doing so;

- ways to increase sales with a cashless payment system: how to set up a point of sale, how to motivate customers to spontaneous purchases;

- ways to identify customer needs;

- the organization of workflow, reporting;

- options for dealing with errors during operations with bank cards.

Criterion 6. Additional bank services

If the bank can provide programs for accruing bonuses on the card for completed purchases, which can later be used as a discount, then this favorably will affect not only the reputation of the trading company, but also will increase sales and attract new customers.

For more convenient control of bank card transactions, statements of transactions can be sent by e-mail, using SMS messages or posted on the bank’s website in a special personal account of the organization.

An additional function can be express alerts about system malfunctions, possible fraud, etc., which will allow company employees to respond faster.

Depending on the specifics of the business, functions such as auto checkwhen the terminal is configured to check data with the bank for each specific period of time or, eg, the possibility of paying tips, using a card or indicating in receipts additional information about goods or services that allows you to more closely track payments on them.

Criterion 7. Financial terms of service

One of the most important such conditions is the maximum period of time for which funds are transferred to the organization’s account, the period of which usually fluctuates. from 1 (one) until 3 (three) days and Depends on the following factors:

- the presence of an account at the acquiring bank with an enterprise accelerates the transfer made the very next day;

- making a purchase from an acquiring bank card provides a transfer during the day;

- the presence of an urgent transfer program that speeds up the process, regardless of other factors.

Buyers are most concerned about for what period will the funds be returned to the cardin case of return of goods. It is also an important point for the work of the outlet, ensuring its reputation.

It is equally important to immediately assess the necessary costs for the regular use of acquiring, which, as a rule, include:

- fee for installation of equipment;

- connection to the server;

- rental of necessary equipment;

- Maintaining and maintaining proper system operation.

Criterion 8. Compare acquiring rates in different banks

Payment for cashless payments may be set as interest rate from each transaction. In this case, it is debited in the form of a commission for each operation performed.

When determining the tariff for using the service, individually, factors such as the sphere in which the organization conducts its activities, its existence in this market, the number of branches, the firm’s turnover, the number of licenses the bank has to conduct transactions from various payment systems and the presence of its own processing center with the bank should be taken into account.

7. A package of necessary documents for concluding an acquiring agreement

When concluding an acquiring agreement with a bank, a legal entity will need to provide a standard package of documents:

- Certificate of USRLE or, for registered after 1.07.2002. organizations; Certificate of registration from the tax office;

- Certificate of tax registration;

- Package of constituent documents;

- Extract from the register;

- Bank card with sample signatures;

- Decisions or orders on the appointment of the director of the organization and chief accountant;

- Lease agreement or documents confirming the ownership of the premises located at the actual address specified in legal documents. We wrote in detail about the legal address in a separate article.

- Bank statement on opening a correspondent account, or a copy of the settlement and cash services agreement;

- License for activities according to the declaration;

- Copies of passports of accountant and director, notarized;

- Any additional documents that the bank may request, in accordance with internal rules.

You can familiarize yourself with all the terms of the acquiring agreement by the link below (using the example of a VTB24 bank agreement):

Download a sample of VTB24 Bank acquiring agreement (doc. 394 kb)

Download a sample of VTB24 Bank acquiring agreement (doc. 394 kb)

8. The main features of the payment system (acquiring)

The following features of the acquiring service can be distinguished:

- all issues of interaction between the parties are strictly regulated by the contract;

- an individual approach may be applied for each contract;

- the trading company pays the commission to the acquirer in the form of a personally calculated percentage of card transactions. Usually, it ranges from 1.5% to 4% of the amount of the operation.

- the necessary equipment, as a rule, is provided by the bank itself (for a fee, for rent or for free, depending on the terms of the contract), as well as related services: promotional products, employee training and so forth

- the lack of an account at the acquiring bank is not an obstacle to using this service. But its presence may provide additional preferences.

- the payment for the goods is not credited to the organization’s account immediately, but within one to three days.

It is imperative to take into account the above features when using this service.

The main pros and cons of acquiring for entrepreneurs

The main pros and cons of acquiring for entrepreneurs

9. Advantages and disadvantages of acquiring

We list the main pros and cons of using the service.

Pros (+) of acquiring

- The main advantage of using acquiring for the seller remains an increase in the purchasing power of consumers with cashless payments with plastic cards. In this case, according to studies, buyers are willing to spend more, on average, on 20%because It is psychologically easier to part with cash in non-cash form than in cash.

- Currently, more and more potential buyers are storing their money in accounts, and not in their wallet, and, accordingly, they may not have the right amount of cash, while they can be found on the card.

- Reducing the risk of counterfeiting banknotes and errors in the issuance of change simplifies the work of the cashier. The entrepreneur saves on encashment of cash and commission for their institution on the current account.

Cons (-) of acquiring

- Bank transaction fee may be 1,5-6% from its amount.

- Money received from the buyer does not arrive at the account immediately, but within 1-3 days.

- The costs of acquiring / renting equipment for acquiring and its maintenance.

10. Frequently Asked Questions about Acquiring (FAQ)

Consider the popular questions asked by users on this topic of publication.

Question 1. Why small and medium-sized businesses acquiring?

In today's world, acquiring in average and small businessjust needed. Otherwise, in a competitive environment, the seller simply will lose its customers. Due to the fact that, having no way of cashless payment, most buyers, simply, will choose another outlet where it will be possible.

After all, on the card to store money much more convenientMoreover, the majority of consumers receive their income (wages or social benefits), or at least a part of it on a bank card.

Accordingly, without cash in the wallet, it is more likely that the client will find the right amount on the card balance, which, undoubtedly, more often leads to spontaneous purchases, and therefore entails an increase in business profitability.

In addition, the use of acquiring in the bank makes it possible not only to expand customer basebut to increase company profits, respectively.

Question 2. What acquiring equipment is used?

Making cashless payments, of course, impossible without special hardware and software. Providing the service of acquiring, the bank also provides the necessary equipment. Entrepreneur may purchase it at full cost, rent from a bank or get on othersspecified in the contract conditions.

First of all, of course, POS terminal or POS system as a whole. The terminal is necessary for reading information from plastic cards and providing authorization in a system that allows you to debit money from an account. As a rule, they need as many as the cash desks in the store.

Wherein, there are several types of terminals, which can be stationary, wireless (e.g. for couriers or waiters), PS terminals (for sales through the company website), and they may also have different functionality and withread cards with a chip or magnetic stripe and provide an opportunity for contactless payment.

System it also represents a complete set of devices needed to ensure the work of a cashier’s place and to conduct non-cash transactions.

An imprinter is also used to issue slips - specialized payment documents confirming the fact of cashless payment.

Pinpad - panel for entering a PIN code by a client. It connects to a POS terminal or cash register and is necessary for transaction security.

Recently, cash solutions are widely implemented that implement immediately reading and information encryptionreceived from the card. They make the payment process faster, safer, simplify reporting on financial transactions and print checks.

It is worth noting that for Internet acquiring only the module is required, to which the site is connected for authorization. Since the card is not physically presented, and the check / slip is not printed, there is no need for other equipment.

Question 3. Where to buy / rent equipment for acquiring?

You can rent an acquiring terminal (apparatus) from acquiring banks, where you will connect this service. Acquiring equipment rental starts from 500 rubles / month or more.

You can also buy bank POS-terminals from other companies that sell and lease equipment. You can purchase such equipment in installments.

Here are some companies that provide such opportunities.

1) Accept the card!

Primikartu has the following advantages:

- Quick connection of equipment without a visit to the bank;

- A minimum package of documents is required;

- Connection is possible without failure of the acquiring bank;

- Opening a new current account is not required;

- 24-hour service support and a secure payment guarantee;

Here you can buy equipment in installments or rent for a certain period.

2) First Bit

The company has a large number of branches throughout the country, including in the CIS countries, the UAE, etc.

There is the possibility of acquiring KKM, RKO and other services for starting and expanding a business.

Possible solutions for the optimization and automation of the enterprise.

11. Conclusion + video on the topic

In this article, you got acquainted with the definition of acquiring, its main characteristics, weaknesses and strengths.

note, what since 2015 for enterprisesreceived revenue from 60 million rubles, the presence of a non-cash payment method is compulsory.

The law provides for a penalty for non-compliance with this requirement, in the amount of up to 30 thousand rubles (for IP) and 50 thousand rubles (for legal entities).

In conclusion, we recommend watching a video about acquiring (basic types, the principle of acquiring):

Now you know the basic principles that should be followed when choosing a partner bank, you can draw conclusions about the main participants in the acquiring services market and determine the conditions on which you want to cooperate with any credit institution in this direction.

We wish you to choose a worthy acquirer and find the most comfortable conditions for your company, which will expand the range of services you provide, increase the demand for your goods and, accordingly, get the maximum profit.

Dear readers of RichPro.ru magazine, we will be grateful if you share your wishes, experiences and comments on the topic of publication in the comments below. We wish you financial prosperity for your business!