Currency exchange (currency exchange) - what it is and how to conduct currency trading online in real time + 4 valuable tips for beginners

Welcome readers of the financial magazine Rich Pro! In this article, you will learn what a currency exchange is, who provides access to a currency exchange online and how real-time currency trading is carried out.

At the end of the article, we traditionally answer the most popular questions, as well as provide expert advice to beginners on successful bidding.

It is useful to study this publication for those who plan to conduct trading on the currency exchange, as well as those who are interested in finance. If you belong to one of these categories, do not waste time, start reading right now.

We will talk about what a currency exchange is and how trading is conducted on a currency exchange online - in this issue

We will talk about what a currency exchange is and how trading is conducted on a currency exchange online - in this issue

1. What is a currency exchange - an overview of the concept

So what is a currency exchange?

Currency exchange - This is a platform on which the purchase and sale of monetary units of various states is carried out. Currency exchange is often called Forex trading, but it is not so. About what Forex is and how to make money on it, we wrote in detail in a previous article.

Originally The goal of creating a currency exchange was to ensure the convenience of currency exchange. However, gradually this task receded into the background. Today Forex is primarily used to make profit for traders.

It is not possible to determine the exact turnover of the foreign exchange market. However, studies show that on average it exceeds 4 trillion dollars.

A large number of bidders can be distinguished:

- individuals

- investment funds;

- central banks;

- brokers.

Brokers act as intermediaries between the exchange and the trader. In the process, they execute trade orders, receiving a reward for this. Broker commission is charged in the form spread.

Spread - this is the difference between the purchase price and the sale price of the currency.

The currency exchange is open 24 hours a day on weekdays. At the same time, many modern brokers allow you to simultaneously trade on the currency and stock exchanges. At the last, work with securities is carried out - stocks, bonds and derivatives thereof.

An important difference between the Forex market and the stock exchange is trade exclusively through the Internet. There is no special room for currency trading. There are, of course, special sections on exchanges, egon Moscow. However, they were created only for the convenience of trading; currency pricing is not carried out here.

Important advantage the market Forex trading are special currency price fluctuations. They move relatively stably. If sudden jumps occur, most often prices return to a certain range during a certain time period.

In the stock market some tools can completely depreciate. This occurs during the collapse and bankruptcy of the companies that issued them.

Important! Due to the fact that sharp collapses in the foreign exchange market are much less common, it easier to analyze than stock. The predictions made are more accurate.

This is not the only difference between the stock and foreign exchange markets. For ease of perception, we have compared the various characteristics of the markets in the table below.

Comparison table of differences between the foreign exchange market and the stock market:

| Comparison characteristic | Currency market | Stock market |

| Working hours | 24 hours a day, monday to friday | Locked at night |

| Traded Instruments | Currency pairs of different states | Securities |

| Leverage | It is applied in trade | Big shoulder not used |

| Place of trade | Online exclusively | There are exchange buildings in major cities, and you can also trade via the Internet. |

Forex Attracts Newbies by Having leverage. By purchasing the currency, the trader deposits only part of the funds into the account, he takes the rest of the money from the broker. The amount of borrowed funds depends on the amount of leverage.

Leverage represents a ratio that shows how much of the equity the trader uses in the transaction, and how much he takes from the broker.

In the stock market, a large leverage is not used. Therefore, for trade you have to deposit a fairly large amount of funds. Do not forget that stock market instruments are quite expensive. This is especially true for markets. Of Europe and America.

2. The main functions of the currency exchange

The functions of the currency exchange are due to the fact that the uncontrolled activities of traders can lead to unpredictable effects.

Do not forget that the distortion of exchange rates provokes serious problems in the economy of various states.

Described below 4 main functions of the currency exchange.

1. Pricing

One of the most important functions of a currency exchange is pricing. Traditionally, price is understood as an agreement between the seller and the buyer regarding the value of a particular product.

On the currency exchange, this definition is not absolutely reliable. The fact is that the exchange does not take into account the opinion of two parties to the transaction, but a huge number of people and organizations acting at a particular moment in the market.

Prices are not formed on their own, but are based on many different factors:

- political and economic news;

- military conflicts;

- natural disasters;

- market sentiment (i.e. most bidders).

It is these factors that determine the degree of fluctuation, predictability, and other important phenomena.

The results of pricing are reflected in the charts. The result is an image that allows you to assess the change in the value of the instrument, formed under the influence of the market.

Traders who have been analyzing the market for many years can identify tendencies price changes. The main influence on them is exerted by the largest market participants. They are usually called majorities, which include central banks, as well as major investment funds.

2. Calculation and adjustment of prices

By the way, you can trade financial assets (currency, stocks, cryptocurrency) directly on the stock exchange. The main thing is to choose a reliable broker. One of the best is this brokerage company.

If speculators are given free rein, they can collapse the exchange rate. Therefore, prices are controlled by central banks. They use the main tool for influencing courses. the intervention, which is understood as the purchase and sale of foreign currencies. Other tools are also used to adjust prices.

It is important to understand! Actually traders profitablythat central banks regulate exchange rates. Thanks to control, their oscillations occur within a certain corridor.

At the same time, speculators have the opportunity to make good profits by concluding deals in areas overbought and oversold. In order to determine the named levels, traders use various indicators.

In some cases, the Central Bank may refuse to control the exchange rate of its currency. The result can be a sharp unpredictable jump, which leads to losses for many traders.

EXAMPLE: This is exactly what happened with Swiss franc at the beginning 2015 of the year. Up to this point, the currency in question was quite stable. When the central bank ceased to fix its value, the rate changed sharply.

A sharp jump in the Swiss franc (CHF) rate on the currency exchange

A sharp jump in the Swiss franc (CHF) rate on the currency exchange

In a short time, the value of the currency increased 1⁄3. Subsequently, it gradually returned to its previous level, but stability was lost forever.

3. Organization of bidding

Currency exchange unites participants in currency trading. Among them prevail brokers and traders.

The former are engaged in creating favorable conditions for trading on the exchange. To this end, brokers provide speculators special terminals, which allow you to analyze the market and place orders, making money.

4. Selection of trade participants

Only large market players can influence the value of currencies. However, with the development of the Internet, absolutely everyone got the opportunity to participate in trade. It is enough to open a special account and deposit a minimum amount into it.

But do not forget that newcomers very often give in to emotions. They are often possessed by greed or fear. The result is deposit drain, the market crowds out inexperienced traders through natural selection.

The currency exchange is a rather complex economic organism. It performs important functions during the regulation of value, as well as the organization of trading in currencies.

3. What are currency trading on the exchange

Currency exchange tools are currency pairs(e.g. EUR / USD). Their name consists of two currencies (euro / dollar). To make money on the currency exchange, just open a position on purchaseexpecting growth cost, or at sale while waiting for her decline.

Naturally, most small traders are not able to correctly predict the further movement of quotations in the market. They open deals when the trend is already actively developing.

Experts say that quite often a market reversal follows an active growth in the number of transactions in one direction. In other words, don't run after the crowd. If a change in the direction of movement of quotes follows, you can get a huge loss.

Many believe that trading on the currency exchange is not difficult. This opinion is due to the fact that there is only 2 currency transaction categories - purchase and sale.

But the main difficulty of trading lies in the inability of most traders to correctly determine the right moment to enter and exit the market. For successful trading, you need to know the methods of forecasting further price movements.

To select the time of purchase and sale, special techniques are used, which are divided into 2 large groups:

- fundamental analysis;

- technical analysis.

Course Prediction Using fundamental analysis implies a thorough study of the economy as a whole.

Many traders use news trading. They analyze upcoming events in the economies of various countries and based on them make forecasts about changes in the value of currencies. Often, an unexpected development of events leads to a sharp change in quotes.

In a fundamental analysis, the following indicators are monitored:

- inflation and unemployment rates;

- size of GDP;

- key rates of central banks.

It is important to keep in mind that fundamental analysis gives good results exclusively over the long term.

Worth considering! Short-term traders do not carefully study the economic situation. It’s more important for them to determine who is stronger on the market - bulls or the Bears. The former make a profit when the value of currencies grows, the latter - when they fall. Determining the prevailing market sentiment helps technical analysis.

Technical analysis of currency pairs

Technical analysis of currency pairs

Technical analysis requires comprehensive study of the current market situation. Its purpose is to predict the further movement of quotes based on historical price data.

There are a huge number of technical analysis tools:

- support and resistance levels;

- trend lines;

- various indicators;

- figures of Japanese candles, etc.

A beginner, regardless of what time periods he plans to work on, should study the basics of the two analysis groups. However, in most cases, technical analysis is easier to read.

4. What are the advantages of trading on the currency exchange - 4 main advantages

Most traders begin familiarizing themselves with Forex trading, where the main tools are currency pairs. This market has a number of the benefits before stock. Let's consider them in more detail.

1) Leverage

In the Forex market, the currency is sold by the so-called lots. This means that you cannot make a deal with several monetary units.

The size of one lot is 1,000 units, therefore, any transaction must be a multiple of one thousand.

Naturally, far from all individuals have the opportunity to deposit into the account an amount sufficient to purchase at least one currency lot.

It helps to solve the problem leverage. It is a ratio that shows how much of the equity the trader uses in the transaction, and how much he takes from the broker. The maximum leverage usually does not exceed 1:500.

Experts do not recommend trade with a leverage of more than 1: 100.

On the one hand, leverage allows you to earn more by using in the trade an amount in excess of the amount available to the trader. However, do not forget that this increases the riskiness of trade.

EXAMPLE: So, if the shoulder is level 1:10, and the trader opens a deal using all his means, falling at 10% will lead to a complete loss of the deposit.

2) Remote trading capability

Stock exchanges initially worked in the hall, much later they began to work online. At the same time, Forex was immediately created as a market that works via the Internet.

For currency trading there is no need to leave the house. It is enough to install a special program on a computer or any mobile device called trading terminal. After that, an analysis is required and a deal can be opened.

Through the Internet, Forex is not only trading. Also online, you can receive news, as well as study analytics.

3) 24 hours trading

Trading is conducted in the stock market in sessions; the stock exchange closes at night. In contrast, the currency exchange operates around the clock. The market closes only for the weekend. Even during a break in the work of the currency exchange, the exchange rates of currency pairs are carried out.

Often after the weekend, under the influence of serious events, traders observe a gap in the exchange rate of a currency pair. This situation is called gap. However, it occurs less frequently than on the stock exchange. This is due to the fact that Forex closes only on weekends and holidays.

A clear example of a stock gap (price gap)

A clear example of a stock gap (price gap)

On some days, trading on a specific instrument is not conducted, since the pair includes the currency where the national holiday comes.

4) Source of additional income

Some traders use in trading. short time intervals. They monitor the market on time frames a few minutes long.

Traders who earn on the slightest price change are called scalpers, and the strategies they use are scalping. Such speculators are forced to spend a lot of time around the computer.

Not everyone has the desire to devote a huge amount of time to trading. Currency exchange allows you to trade with minimal cost. This can be achieved by working with medium and long time intervals. Such trading can be a great opportunity for additional income.

Thus, Forex has several advantages over the stock exchange. Experts recommend novice traders work in the forex market.

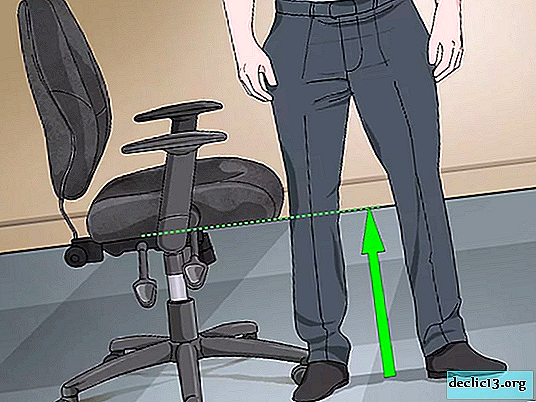

The main stages of conducting currency trading online (in real time)

The main stages of conducting currency trading online (in real time)

5. How are trading on the currency exchange online - 5 main stages

Many beginners, when deciding to do trading, do not know where to start. It is worthwhile to understand that it will not be possible to immediately achieve overwhelming success.

However, there is a way to speed up the infusion into the process - just use instruction from professionals. It describes the steps that a trader will have to overcome at first in order to succeed.

Stage 1. Choosing a broker

It is important to take the choice of a brokerage company as seriously as possible. If a trader opens an account with a fraudster, he will be almost completely without money.

Today in Russia there are a large number of reliable brokerage companies. To choose the best broker, it is necessary to take into account not only favorable tariffs, but also its other characteristics. One of the best is this broker.

When choosing a brokerage company, you should pay attention to the following points:

- term of work in the market;

- reputation;

- availability of a license;

- insurance guarantees;

- reviews.

By the way, there is a separate material on our website where the rating of Forex brokers is presented - we recommend that you familiarize yourself with it.

Stage 2. Opening a trading account

Typically, newcomers easily open a trading account, as this procedure is quite simple and understandable to everyone.

To open a trading account, it is enough to do just a few actions:

- registration of a personal account;

- filling out a small questionnaire;

- transfer of funds on deposit.

Each broker independently sets the minimum amount with which you can start trading.

Stage 3. Analysis of the market situation

As soon as an account is opened, and funds are deposited into it, a trader can start trading.

It is important to consider! Do not immediately open a deal, relying solely on intuition. You can only do this when working with binary options.

When concluding transactions for the purchase or sale of currency, one should rely on the results of the analysis. Most reliable brokers spend special classes by methods of fundamental and technical analysis. Most often they are absolutely free.

Stage 4. Development of a trading strategy

Some advertisements say that they can offer beginners an optimal strategy that will bring huge revenue always and on any financial instrument. Do not believe this, such trading plans (strategies) do not exist.

Trading strategy suggests development of rules for entering the market, as well as exit from it. It is important to decide which method will be used to determine when to open deals. In addition, the strategy obliges to establish under what conditions to take profits, as well as losses.

The next moment becomes trading strategy check. This can be done using historical data on the value of currency pairs. There is another option - demo account. Most modern brokers offer them. This account allows you to check the performance of the trading strategy without risking real money.

Important at this step also assess the possible level of risk. To do this, it is assumed that the market went in the direction opposite to the expectations of the trader, and did not return back.

Important, so that the loss on one transaction does not exceed 2% of the deposit amount. If this rule is violated, the risk of a complete drain of funds from the account increases significantly.

Stage 5. Start of trading

Only after the trading strategy has been developed and tested, you can proceed directly to the online trading. In principle, there are usually no difficulties.

First of all, you should choose transaction volume. Further, if the trader expects further growth, he acquires a currency pair by pressing the button Buy. If the speculator suggests a depreciation, he sells the currency by clicking on Sell.

In the trading process, it is important to give up emotions as much as possible. Do not deviate from the developed trading rules and make transactions under the influence of intuition alone.

Exactly adhering to the plan described above, even a novice trader will be able to start trading. It is only important to treat this as a job without risking your own money.

Do not forget that exchange - not a casinoTherefore, trading only on the basis of intuition inevitably leads to a drain of the deposit.

6. Who provides access to online currency trading (in real time) - TOP-3 popular brokers

Sometimes choosing a good broker is not easy due to the presence of a huge number of companies in the Russian financial market. Making the right decision helps the advice of the specialists who make up reviews of the best brokerage companies. Below is one of them.

1) FXclub

Forex club operating in the CIS since 1997, he became the first broker here. Since that time, the Forex club has absorbed many small market participants, has grown into a large group of companies.

Forex club operating in the CIS since 1997, he became the first broker here. Since that time, the Forex club has absorbed many small market participants, has grown into a large group of companies.

Today, FXclub offers a huge number of investment programs, strategies and conditions that are suitable for both beginners and experienced traders. Many experts believe that the Forex club provides the best analytical support to traders.

Among the company's services you can find the following:

- investment ideas;

- trading ideas and recommendations;

- forecasts from a well-known analytical agency;

- trading signals;

- daily analysis of the situation in the foreign exchange market.

Stimulation of customers is carried out using various bonus programs:

- on the first and each subsequent replenishment of the trading account;

- interest on the balance of funds on deposit;

- for each attracted trader.

By registering on the official website of a brokerage company, you can begin to conduct foreign exchange trading online.

2) Finam

One of the most important the benefits broker Finam is the availability licensesissued by the Russian Central Bank. Traders registered in Finam can work not only with currencies, but also with securities issued both in Russia and abroad.

One of the most important the benefits broker Finam is the availability licensesissued by the Russian Central Bank. Traders registered in Finam can work not only with currencies, but also with securities issued both in Russia and abroad.

Beginners are unlikely to be able to start cooperating with the Finns:

- Firstly, for most training courses here you have to pay.

- Secondly, the minimum amount for opening an account is higher than that of many other brokers.

3) Alpari

Alpari - A broker that provides its clients with quality training programs. First of all, beginners are advised to take basic courses and only then begin to study programs dedicated to specific trading strategies.

Alpari - A broker that provides its clients with quality training programs. First of all, beginners are advised to take basic courses and only then begin to study programs dedicated to specific trading strategies.

Training programs offered in Alpari can be:

- free (most programs);

- paid;

- shareware.

Paid classes are a unique development broker. You can access them by replenishing the account for a certain amount. In most cases, it is enough to deposit 100 dollars.

However, for more experienced traders, classes will be suitable for access to which you will need to replenish your account at 1000 dollars. At the same time, money will not be used up and if necessary it can be withdrawn.

When choosing a broker, for beginners, experts advise turning to ratings from professionals. In this case, you do not have to analyze a huge number of characteristics for all companies. It is enough to study the description of brokers and choose the appropriate one.

7. How to successfully conduct trading on the currency exchange online - TOP-4 useful tips

Beginners in trading have to simultaneously master a large amount of information - the nuances of starting a trade, the basics of analysis, the characteristics of brokers.

In a large flow of information, you can easily get confused and lose money. Help facilitate the task professional advice.

Tip 1. Work only with trusted brokerage companies.

Some brokers intrusively offer their services. Experts advise to abandon them even when offering very attractive conditions for cooperation.

Worth considering! Working with companies that have not been tested by time and a large number of customers can be very risky.

There are many scammers in the financial market, cooperation with which may cause delays in withdrawing funds or a complete loss of money.

Tip 2. Continuing study

Experts recommend continuous self-development and training. Even before the start of trading, you should master basic course the chosen broker who will give an understanding of the basics of trading.

The next step should be a thorough study of the trading platform. It is important that all operations by the speculator be carried out automatically.

Important! Once it is possible to achieve automatism in trade, we can begin to study various strategies and areas of analysis. This will help develop own trading plan.

Do not neglect Forex training, since without it it is impossible to become a professional in trading. And this means that it’s unlikely to earn much.

Tip 3. Observe discipline

It is important to strictly follow the developed and tested trading plan. Should learn to use pending orders, do not neglect levels Stop Loss and Take Profit.

Violation of trade discipline - early closing of orders with profit or loss, at any time can lead to a complete drain of the deposit.

It will not be amiss to remind once again: you should not trade, relying solely on intuition, since it very often deceives.

Tip 4. Exclude emotions from trading

There are often situations when the value of currencies, contrary to expectations, abruptly begins to move in a different direction. At the same time, many traders are tempted to make money on such a movement, entering the market contrary to the trading plan with a large lot. This can lead to huge losses and a complete drain of the deposit.

A simple rule helps avoid collapse - don't give in to emotions, trading should be clearly adhering to the strategy.

It is important to remember that the exchange does not feel sympathy for any trader. She can trap spontaneous movements. Prices never go as the trader wants. therefore trust analysis, not intuition.

The above tips help beginners to cope with difficult situations at the stage of becoming a trader.

Violation of the basic rules often leads to a drain of the deposit. This explains the huge number of reviews on the Internet that claim that Forex is a scam.

8. FAQ - Frequently Asked Questions

Newcomers to the currency exchange inevitably face a huge flow of information. Sometimes it’s not easy to figure it out, and questions pile up like a snowball.

We traditionally facilitate our readers' task and save their time by answering the most popular questions.

Question 1. What time are trading on the currency exchange?

A distinctive feature of the currency exchange is round-the-clock trading. The market closes only on weekends and holidays.

Important! No trader can work continuously. Therefore, it is important to choose the right time ideally for opening deals.

Naturally, you will be able to get maximum profit only during activity on the exchange. It’s unlikely that you will be able to earn money during quiet hours.

The greatest activity on the currency exchange is observed during 3 main sessions:

- Asian (Tokyo);

- American (New York);

- European (London).

The table below shows the Moscow opening and closing times for each of these sessions.

Table of 3 main sessions of the currency exchange and time (MSC) of their work:

| Session | Opening | Closing |

| Asian (Tokyo) | 2-00 | 12-00 |

| European (London) | 11-00 | 20-00 |

| American (New York) | 16-00 | 1-00 |

The table shows that during the day there are hours when two exchanges work simultaneously. It was at this time that market activity was maximal. Among the sessions, the most active is European.

However, The volatility of currency pairs also depends on the day of the week and month:

- In the middle of the week (Tuesday and Wednesday), the activity of traders is greatest.

- On Friday, as well as at the end of the month, many speculators close positions opened in previous periods. These days are difficult to analyze and predict.

Experts recommend suspend trading during the holidays, as well as before the release of the most important news. At this time, it is not easy for newcomers to make significant profits.

Question 2. What is the Forex currency exchange?

Forex trading represents the international currency market. Its main task is the organization of transactions with currencies.

The value of various monetary units is almost in continuous motion. Thanks to this, traders have the opportunity to make good profits by working on Forex.

The largest Forex participants, who in most cases dictate trends, are:

- central banks of various countries;

- large investment structures.

In quantitative terms, small traders prevail among market participants. However, the share of their financial investments is insignificant.

It is quite difficult to accurately determine the volume of transactions made on Forex. But experts estimate that on average daily currency turnover reaches 3 trillion dollars. Wherein average size of operations is almost 1 million dollars.

Nevertheless, small speculators have the opportunity to bid, investing a much smaller amount. To do this, it is enough to use the services of intermediaries, called brokers.

9. Conclusion + video on the topic

Currency exchange is a complex mechanism that is constantly in motion. Currency exchange provides an opportunity to earn during the course of currency trading and make good profit.

However, you should not believe anyone who says that without much effort, Forex allows you to get rich. Such statements are nothing more than a banal advertising move. To get a stable profit, you will have to not only invest a certain amount, but also constantly study.

We also recommend watching a video about what a currency exchange is and how to make money on it:

That's all with us!

We wish readers of the RichPro.ru website successful bidding on the currency exchange. See you on the pages of our online magazine!

If you still have questions about the topic of the article, then ask them in the comments below. Do not forget to share the publication in social networks with your friends!